Lyd Explains: Personal Finance Basics

Having a basic understanding of your finances is key to planning your life! Managing your money intentionally will give you control over where your money goes so you can spend it where you want. Here are the principles and financial basics that I focus on the most, practice makes perfect!

Financial Awareness is the first step to taking control. Though it may be painful (at first), you have to understand where you are before you decide where you want to go. Here is an exercise, to learn where your money is being spent. So review the last month:

- List all of your income

- List all of your bills and expenses, including credit card spending

- Next to your bills and expenses - calculate the % of your income that the expense was

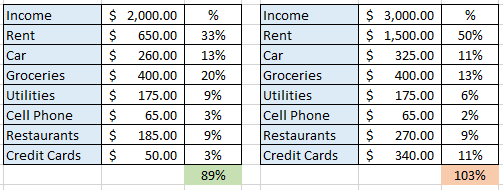

- Here's an example

- If you are under 100% you are in the "green" meaning you spent less than you made

- If you are over 100% then you are in the "red" and you are spending more than you make

- What was my biggest expense?

- Which were unplanned expenses?

- Did I spend more on anything that I thought I would?

- Did I save as much money as I wanted to?

Budgeting is an estimate of income and spending for a set period of time. This is how you control where your money is going. Creating a budget is making a list of your expenses (and savings) with the "goal" amounts you plan to spend on them. Then as you spend, you will reference your budget to see if you spent more or less than you planned.

If you want to make changes to your financial space, a budget is where you decide what expenses you want to spend less on OR eliminate from your spending. You can impact your finances in 2 ways, make more money or spend less money. Spending less can be a good place to start.

Once you have become similar with your finances, you can create some Goals! Common financial goals are to pay down debt or save for something special. When creating a financial goal, think about the amount and also the date that you want to achieve the goal by. Here are some saving goal examples:

- I want to go on vacation, I need to save $1000 - if I save $200 per month, I will have $1000

- I want to have an emergency fund, I want to save $100 per pay to build this

- I want to pay of a credit card early, I want to pay an additional $50 per payment

Saving can be hard and you will need to set money aside from your spending to achieve these goals. The main point is to start and be consistent, even if you can only save $10 per month. This is how you teach yourself the discipline and rewards of saving. This positive association of saving will stick with you! Here are some common ways of proactive saving:

- Auto draft money from your pay into a separate account (interest bearing)

- Cash back at grocery stores to put into a savings box at home

- Action based: Every time you buy a coffee, deposit an extra 5$ into your savings

Financial Literacy is a journey! and you will always keep learning! The internet is full of knowledge but here are my favorite places to find Financial Education.

- Your bank - some offer access to their financial articles that are a great place to stay updated on financial trends and learn about different financial strategies

- Work 401k program - many of these offer regular webinars on saving, investing and other financial skills

- Financial Books - these can be difficult to sort through but rent some from your local library or get recommendations from friends to start! Many financial books aren't about finance but cover how your experience and family history shape your access and view of finances, all great reads

- Talk to other people! I love talking to my peers and mentors about finances, they have many financial experiences that are great to learn from before experiencing yourself

.png)